Alkemi Network

Bridging CeFi to DeFi

Alkemi Network is an institution-grade liquidity network facilitating professional DeFi for financial institutions and individuals to earn yields on their Ethereum-based digital assets.

Capital.

Source deep liquidity for digital assets via permissioned and permissionless pools. Alkemi's compliant liquidity pools provide a trusted counterparty environment.

Connectivity.

Unlock turnkey access to DeFi features and functionality. Alkemi's solutions are optimized for seamless access between Web2 and Web3 digital asset allocators.

Control.

Discover advanced risk management and reporting features via web browser or API access. Minimize risk and maximize value with technology tailored for sophisticated investors.

The first decentralized liquidity network to facilitate both KYC permissioned and permissionless liquidity pools governed by one network utility token.

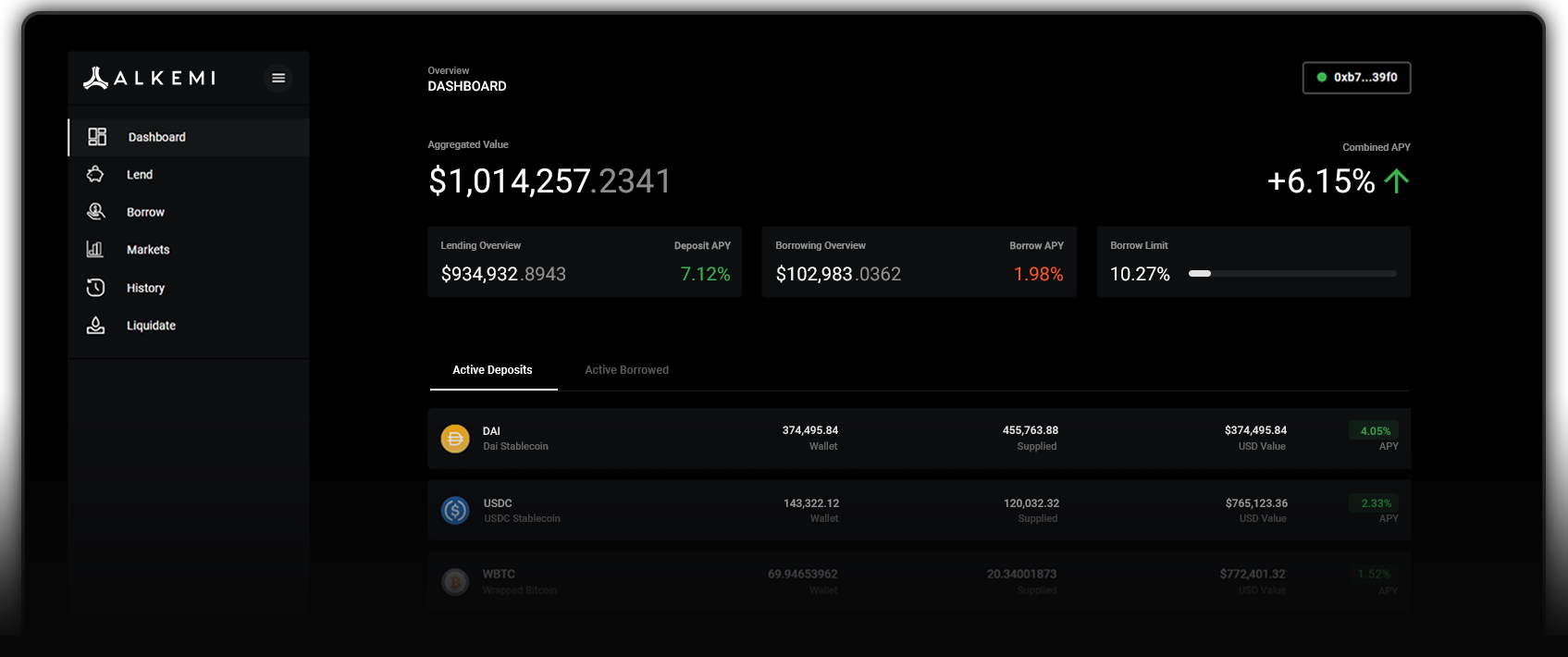

Earn Interest with Alkemi Earn

Borrow and lend across a range of digital asset markets including ETH, WBTC, DAI and USDC.

KYC Approved Liquidity Pool

Unlock guaranteed compliant access to Alkemi Network's permissioned digital asset pool, 'Verified'. Participate in a trusted-counterparty environment of allow-listed users.

Open Access Liquidity Pool

The permissionless liquidity pool, 'Open' facilitates a true DeFi experience for participants whilst maintaining advanced reporting and risk management features.

Institution-grade Reporting

On-demand transaction, asset allocation and balance reports provided as standard.

Web3 and Multisig Wallet Support

Risk and transaction fees minimized, liquidity and control maximized, all streamlined with multiple Web3 wallet support.

Our Customers

Alkemi Network provides the technology for digital asset allocators, exchanges, custodians and individuals to access decentralized financial structured products.

Centralized Institutions

Access to DeFi lending protocols is restricted for centralized counterparties due to compliance risk, a lack of liquidity, limited visibility and insufficient transaction reporting. Alkemi Earn solves these issues by enabling digital asset allocators to borrow and lend with institution-grade functionality.

- Access to Compliant DeFi Pools

- Multisig Wallet Functionality

- Institution-grade Reporting

Centralized Exchanges

Exchanges are limited in providing customers with direct access to DeFi protocols due to compliance, counterparty and infrastructure risks. Alkemi Earn solves these issues by providing exchanges with an embedded DeFi user interface, enabling their customers to borrow and lend from their own platform.

- Access to Compliant DeFi Pools

- Alkemi Bridge SDK

- Embedded User Interface

Private Individuals

Individuals have limited access to detailed trade reporting, risk management and user experience within the current DeFi protocol offerings. Alkemi Earn solves these issues with comprehensive reporting and risk management provided through an intuitive interface.

- Access to Open Liquidity Pools

- User-friendly Interface

- Comprehensive Reporting Features

Frequently Asked Questions

Is there a Liquidity Mining Program available?

Yes, Alkemi Earn participants in the 'Verified' and 'Open' pools are eligible for ALK token rewards. See the Liquidity Mining Program documentation.

Will there be an Alkemi Network token?

Yes, Alkemi Network has a native governance utility token, ALK. ALK tokens allow users to help decide the future of the network.

Do I have to undergo KYC verification to use Alkemi Earn?

No, only counterparties wishing to access the 'Verified' pool are required to succesfully complete KYC / AML verification. Other participants can access the 'Open' pool permissionlessly.

Which digital assets are supported in Alkemi Earn?

ERC-20 compatible assets including ETH, WBTC and stablecoins including USDC and DAI are available in the KYC / AML permissioned 'Verified' pool. ETH and USDC are available in the permissionless 'Open' pool.

Latest News & Blogs

Jun 28, 2022

Ledger adds yield earning capability via Alkemi Earn

Ledger Live has intregated with Alkemi Earn to be able to allow over 1.5 million users...

Mar 10, 2022

Alkemi joins crypto goliaths to build DeFi Standards

Alkemi joins 14 crypto companies partnered with Verite, including Coinbase, Circle, FTX..

Mar 3, 2022

Alkemi Network x Atato | Custody Partnership

We’re excited to announce our partnership between Alkemi Network and Atato ..